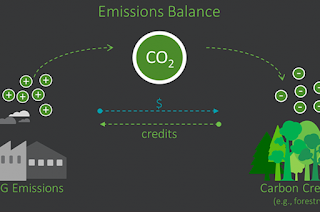

A Carbon Credit Is a Type of Permit, Which Allows Companies to Emit a Certain Level of Greenhouses Gases

|

| Carbon Credit |

A carbon credit is a currency for the reduction of

greenhouse gases. Typically, the carbon credit comes from agricultural and

forestry practices, but nearly any project can create credit. There are two

main ways to buy and sell carbon credits. The first is through a middleman, who

collects emissions data and sells them. The second way is directly from the

projects that capture carbon. This middleman earns a profit on the transaction.

Some governments have set caps on certain industries, such as power and

transportation.

Prices of Carbon

Credits depend on the supply and demand for them. According to the laws

of supply and demand, the amount of carbon credits supplied equals the amount

of demand in the market. However, there is a difference between supply and the

number of buyers, which makes the prices of carbon credits fluctuate. In

addition, the number of credits being sold will vary based on how high the

demand is. Nevertheless, the overall growth in the market is a sign that the

market is ready to accept more projects to meet the quota.

The price of carbon is increasing, and it is expected

to increase further in the future. It is currently valued at between US$1 and

US$139 per metric tonne. Businesses can buy, sell, and retire carbon credits,

depending on their needs. The process of allocating, trading, and holding

carbon credits benefits businesses that are regulated by cap-and-trade systems.

These companies can also earn a profit by reducing their emissions.

The price of carbon is rising. The value of a carbon

credit is essentially similar to the price of a property. The size, location,

quality, and other factors all play a part in determining its value. But like

real estate, the price of a carbon credit is not a simple matter of cost. It is

dependent on supply and demand and is subject to subjective judgment.

Regardless of the market, however, the price of a carbon offset is likely to

increase over time.

Pricing carbon credits is similar to navigating the

real estate market. Credit is assigned to a company that has a specific

pollution cap. The companies are rewarded with credits that allow them to

continue to pollute until they reach their cap. The pollution limit is reduced

periodically. They can sell their excess credits to other companies. Using a

carbon credit increases its value, while it also reduces costs. The value of a

carbon credit can increase or decrease depending on its location and quality.

Get more Insights on

Carbon Credits- https://bit.ly/3sbNr93

Carbon credit price is determined by a market for

carbon. The price of a carbon credit is a commodity, similar to a home. The

price of credit is determined by its market value. A carbon unit is a unit of

energy. If a company emits less than that, it pays a higher amount of tax.

Whether a product is good or bad for the environment is not the only factor

that determines its price.

A carbon credit is a currency, but it has a different

value depending on the standard. A carbon credit may be worth the same in one

country but in another country, it might be worth more in another. If the price

is low, a carbon credit is not worth much. But if it is high, credit is a good

investment. And if it's low, it's a good idea to buy a carbon credit.

Comments

Post a Comment